Samuel Ortom, the governor of Benue State, will be presented with one of Rivers State’s highest honors today in Port

Continue reading

Latest News, Entertainments, Sports and Immigration update

Samuel Ortom, the governor of Benue State, will be presented with one of Rivers State’s highest honors today in Port

Continue reading

Rafael Leao, a transfer target for Chelsea, has received praise from former Premier League players Gary Neville and Ian Wright.

Continue reading

The National Assembly’s proposal to regulate the establishment of Law Schools in the nation has been warned against by the

Continue reading

A bench warrant has been issued by the Lagos State High Court, located in Ikeja, Lagos, for the arrest of

Continue reading

. The aftermath of Nigeria’s exit from the 2018 World Cup and their loss to Ghana in the 2022 World

Continue reading

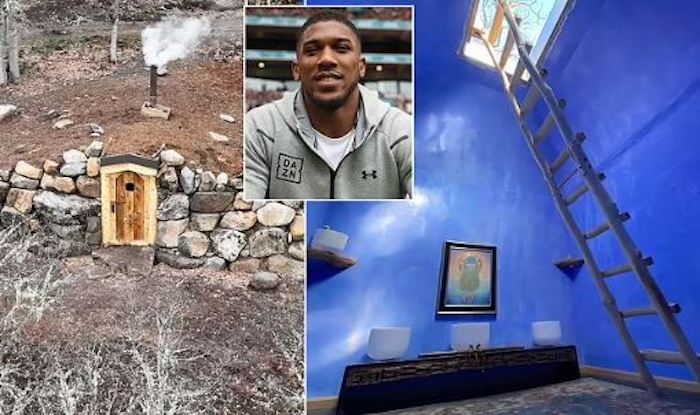

Anthony Joshua, the British-Nigerian boxer who has earned accolades all over the world, is in the midst of an unbelievable

Continue reading

The Invisible Challenge on the short-form video hosting platform TokTok could be harmful, according to the Nigerian Communications Commission’s Computer

Continue reading

Lionel Messi, the captain of Argentina, has expressed surprise at Germany’s exit from the 2022 FIFA World Cup. Remember that

Continue reading

During Operation Hadin Kai in the Damboa area of Borno State, northeastern Nigeria, forces from the 25 Task Brigade killed

Continue reading

Jude Bellingham, a midfielder for Real Madrid, has expressed his wish to continue playing for the Spanish club for more

Continue reading